For your safety online, learn how cryptocurrency can affect you, how it functions and what some of the cryptocurrency-related crimes are.

At its most basic level, a scammer’s job is to find ways to steal your money.

An example would be if a scammer hacked files on your computer and demanded a ransom to release these back to you.

If you decide there is no other option but to pay the ransom, the scammer usually wants their ransom paid in cryptocurrency. Unfortunately, due to the nature of cryptocurrency, you will have no way of getting your money back once the ransom is paid.

What is cryptocurrency?

Cryptocurrency is a digital currency which is 100% online and takes the form of electronic money. All transactions are made via a device (e.g. smartphone, laptop, etc.), without the involvement of a bank.

Cryptocurrency is purchased through an online exchange platform or earnt through a complex mining process that requires advanced computer equipment designed to solve complex mathematics.

There are two reasons people use cryptocurrency; they can make quick payments which exclude the fees of a bank, and they can hold onto cryptocurrency as an investment, in the hope it will gain value.

Cryptocurrency is held in a digital wallet, which is kept either on the user’s device, online or on an external hard drive. The digital wallet is accessed with a public key and private key, which are like very complex passwords.

When did cryptocurrency launch onto the world platform?

In 2008, the cryptocurrency ‘Bitcoin’, and the technology that records Bitcoin transactions, ‘blockchain’, were released. Although Bitcoin remains the most popular cryptocurrency today, there are now many more cryptocurrencies circulating.

This currency is not regulated and has no legalised value. Cryptocurrency is simply worth what people are willing to pay for it on the market.

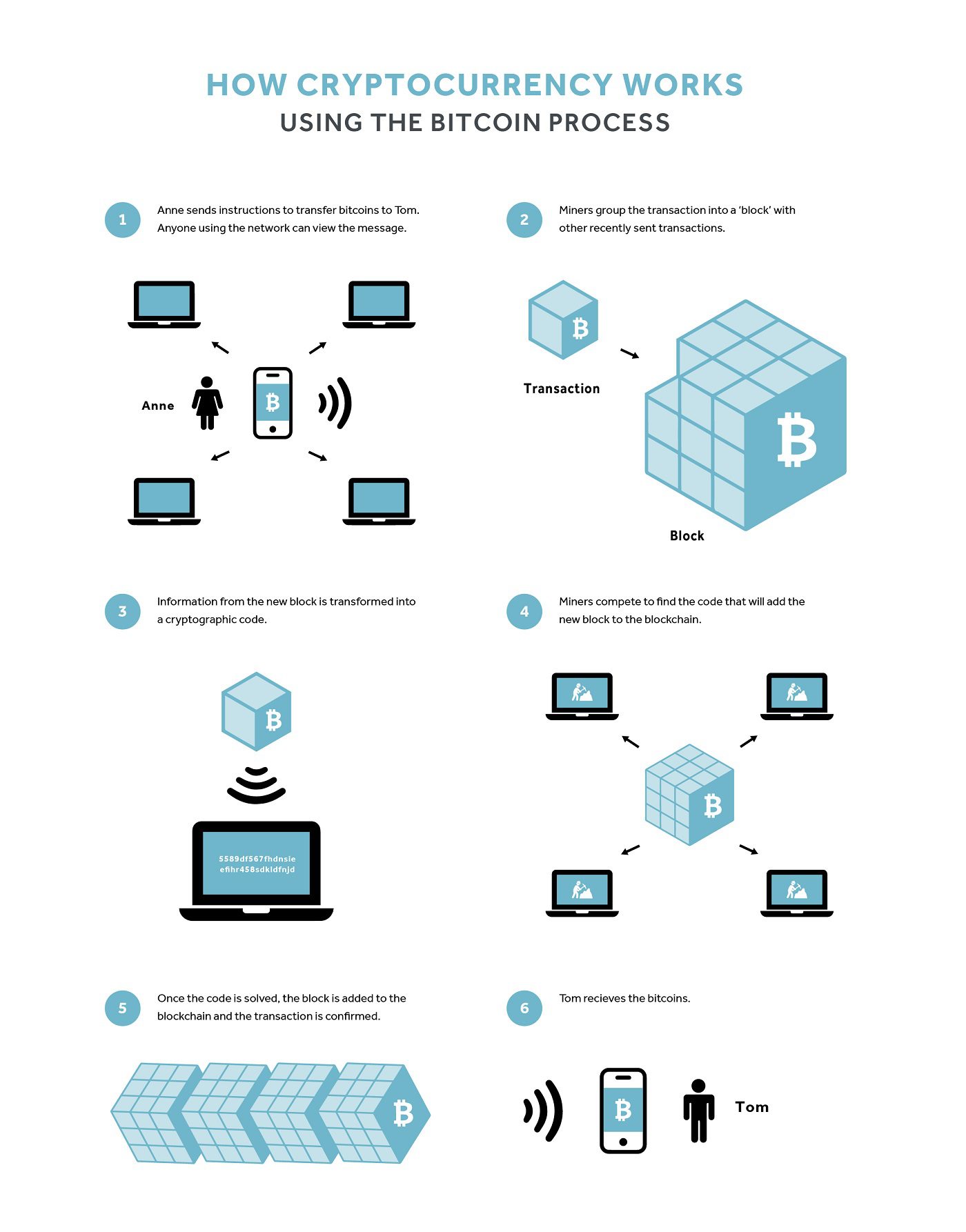

How cryptocurrency works – using the Bitcoin process

Bitcoin works by sending electronic messages to an entire network of computers with information about a transaction.

The transaction includes a time stamp, the electronic addresses of the parties involved and the quantity of the bitcoin to be traded.

So, if you want to transfer 100 bitcoins to a friend:

- You send an electronic message with the instructions to the network, where all users can see this message.

- Your transaction becomes one of several transactions that have recently been sent.

- The transaction sits with the rest of those transactions waiting to be complied into a block.

- The information from this block is turned into a cryptographic code and crypto miners compete to solve the code and add a new block of transactions to the blockchain.

- Once a crypto miner successfully solves the code, other users on the network check the solution to reach an agreement confirming the transaction is valid.

- The new block of transactions is added to the end of the blockchain, and your transaction is confirmed.

This process can take up to 60 minutes, during which, six blocks of transactions will be processed to make sure your transaction has been successful.

Scammers are targeting cryptocurrency investors

With scams becoming more sophisticated, cryptocurrency investments are also becoming riskier. New scams are continually popping up. Below outlines some common scams:

Blackmail Scam: This is where a scammer contacts you to say they have information about you which they will release to embarrass you. They demand payment via bitcoin with the promise of keeping quiet and not releasing the information.

Purchasing Goods: You pay for goods using cryptocurrency which you do not receive.

Fake digital currency investments: CertNZ advise these scams operate by sending out emails, or setting up fake websites, which advertise cryptocurrency investment opportunities with attractive returns.

They also offer fake support from government agencies and celebrities, use dating apps to establish connections, constantly change the bank account details for transfers or use multiple accounts.

A good example of how easy it is to fall prey to a scammer, learn how an Instagram scam, not only cost Jonathan and his friends $20k, but a huge amount of stress and embarrassment.

Crypto wallet private key information: An email is sent out which redirects you to an especially constructed website requesting your personal information. The scammer then steals your cryptocurrency when you provide this information.

Initial coin offerings (ICO): This scam is presented as an opportunity for a project to raise money via the internet. These ‘projects’ are often still in the experimental stage of the development or have not yet started. An ICO white paper provides you with information regarding the person behind the scheme and what they plan to do with the money. This information is not always accurate and may be hard to follow what your rights and obligations are.

You receive digital tokens in return for your high-risk investment in the project. Then the issuer disappears once they have finished fundraising, revealing this was a scam.

Bitcoin stealing malware: This targets Windows and MacOS systems. It previously worked by getting you to download third party software, but now it uses fake websites to trick you into downloading malicious software.

Pump and dump schemes called ‘rug pulling’: A scammer will hype up a cryptocurrency to be extremely popular, and then at the height of the popularity, the scammer cashes out.

Summing up cryptocurrency

The Governor of the Australia Reserve Bank has advised the following:

“One class of technology that has emerged that can be used for payments is the so-called cryptocurrencies, the most prominent of which is Bitcoin.

But in reality, these currencies are not being commonly used for everyday payments and, as things currently stand, it is hard to see that changing.

The value of bitcoin is very volatile, the number of payments that can currently be handled is very low, there are governance problems, the transaction cost involved in making a payment with bitcoin is very high and the estimates of the electricity used in the process of mining the coins are staggering.

When thought of purely as a payment instrument, it seems more likely to be attractive to those who want to make transactions in the black or illegal economy, rather than everyday transactions.

So, the current fascination with these currencies feels more like a speculative mania than it has to do with their use as an efficient and convenient form of electronic payment.”